Little Known Questions About Personal Checking Accounts - OH & PA.

Checking Accounts vs Savings Accounts - Overview, Differences

How Personal Checking Accounts - First Interstate Bank can Save You Time, Stress, and Money.

What Is a Bank account? A checking account is a deposit account held at a monetary institution that allows withdrawals and deposits. Also called demand accounts or transactional accounts, examining accounts are really liquid and can be accessed using checks, automated teller machines, and electronic debits, to name a few techniques. An inspecting account varies from other bank accounts in that it frequently permits many withdrawals and unlimited deposits, whereas savings accounts in some cases limit both.

Examining accounts are really liquid, permitting various deposits and withdrawals, rather than less-liquid savings or financial investment accounts. This Piece Covers It Well for increased liquidity is that examining accounts do not provide holders much, if any, interest. Money can be transferred at banks and through ATMs, through direct deposit or other electronic transfer; account-holders can withdraw funds via banks and ATMs, by writing checks, or using electronic debit or charge card coupled with their accounts.

What's the Difference Between Checking and Savings Accounts

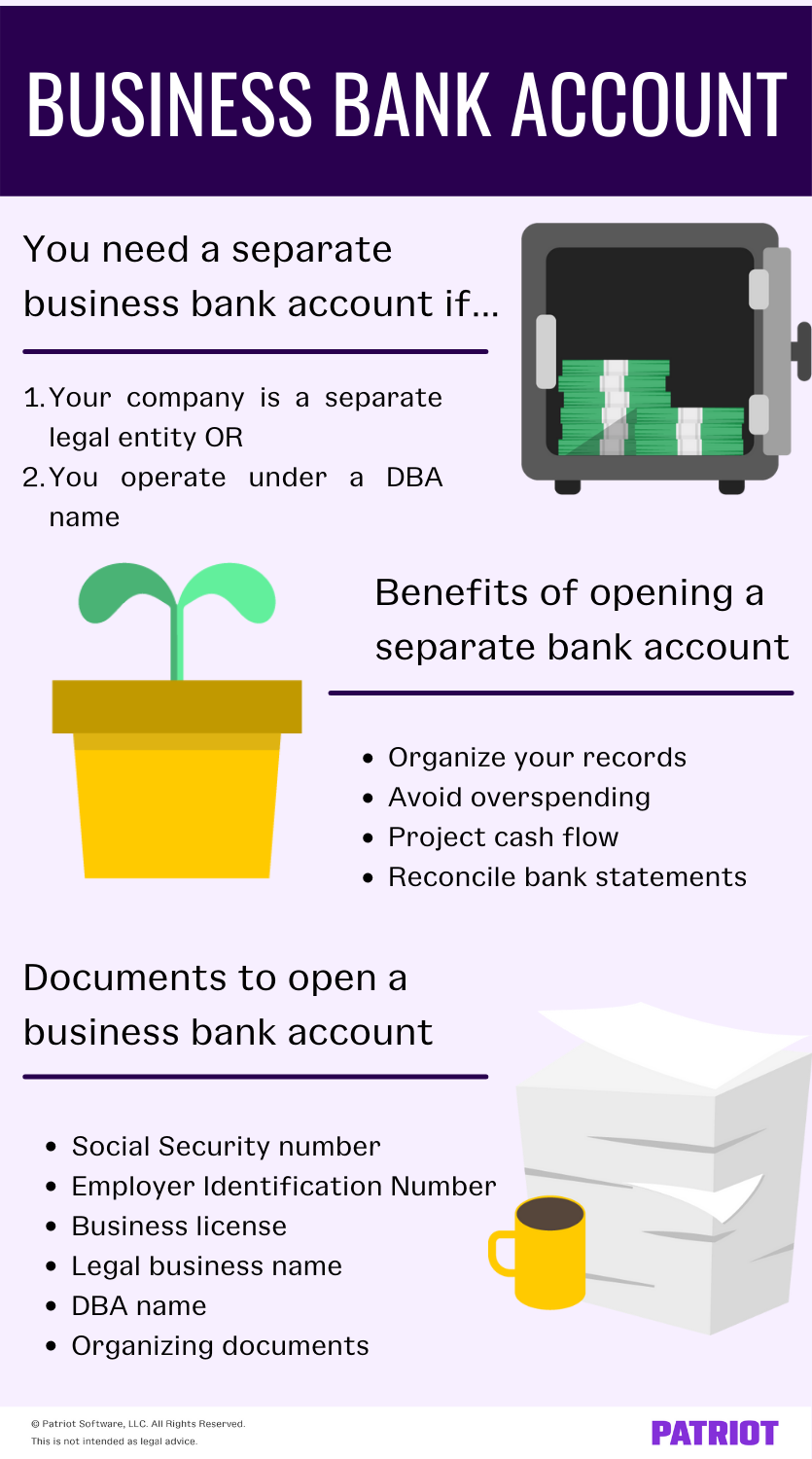

Understanding Checking Accounts Checking accounts can consist of industrial or service accounts, trainee accounts, and joint accounts, together with many other types of accounts that use similar functions. A commercial bank account is used by organizations and is the property of the company. The company' officers and supervisors have signing authority on the account as licensed by the service' governing files.

The Facts About Open A Checking Account - Fremont Bank Uncovered

A joint checking account is one where two or more people, usually marital partners, are both able to compose checks on the account. In exchange for liquidity, checking accounts normally do not offer high rates of interest (if they offer interest at all). But if held at a chartered banking institution, funds are ensured by the Federal Deposit Insurance Coverage Corporation (FDIC) up to $250,000 per private depositor, per insured bank.

What Do I Need to Open a Checking Account?

This involves withdrawing the majority of the excess money in the account and investing it in over night interest-bearing funds. At the beginning of the next service day, the funds are transferred back into the examining account in addition to the interest made over night. Inspecting Accounts and Banks Offering checking accounts for minimal costs, the majority of large business banks use examining accounts as loss leaders.

The objective of most banks is to draw in consumers with complimentary or low-priced bank account and then entice them to use more successful offerings such as individual loans, mortgages, and certificates of deposit. However, as alternative lenders such as fintech business use consumers an increasing variety of loans, banks may have to review this technique.